US stocks recovered from session lows, buoyed by gains in technology companies, but sentiment remained negative as recession fears persisted. Treasuries rose while oil fell.

The S&P 500 pared losses after falling more than 2%, as falling energy prices and bond yields took pressure off higher-valued stocks. After falling as much as 1.9% earlier in the session, the tech-heavy NASDAQ 100 rose more than 1%. Treasury yields fell, with the 10-Yr yield hovering around 2.82%.

The dollar reached its highest level in over two years, making commodities priced in the currency less appealing. WTI Crude Futures fell the most since early March on fears of a global slowdown affecting demand. Copper, a key economic indicator, dropped to its lowest level in 19 months. Energy and mining stocks fell as commodities fell, dragging the S&P 500 down with them.

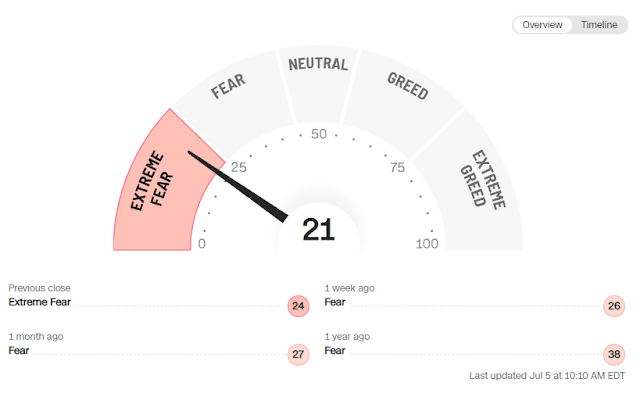

investors continue to worry over a potential US recession and adamant inflation despite talks of tariff reductions.

US and Chinese officials held discussions after reports that Washington is close to rolling back some of the trade tariffs imposed by the former administration. Decreasing tariffs on imported Chinese goods could impact consumer prices in the US, but some suggest that it will do little to dampen inflation.